In Deutsche Bank AG Chief Executive Officer Christian Sewing’s push to get back into growth mode, there’s one specific business in which there are pretty much no hiring limits.

The private bank in Asia is still recruiting, even after bringing on board about 100 relationship managers and support staff in the first half, Lok Yim, who runs the Asia-Pacific wealth business, said in an interview. “I don’t think there’s a limit apart from what we can digest,” he said.

Few businesses offers such eye-watering opportunities for global banks right now as catering to Asia’s swelling millionaire class. While Sewing has cut thousands of jobs elsewhere, in Asia he’s locked in a battle with banks from Credit Suisse Group AG to Morgan Stanley for the bankers who can bring in wealthy clients — and generate revenue from them.

“We’ve been having strategy papers with Christian Sewing,” Yim said. “The discussion is about ‘how much more would you like to grow?’” he added.

Since taking over in April, Sewing has announced plans to cut at least 7,000 jobs and retrench in investment-banking areas such as prime finance and U.S. rates. More recently, however, the CEO has talked about the need to expand some operations. Wealth management in Asia, the Americas and Europe has been identified as among the bank’s most important areas for growth, according to its second-quarter earnings statement.

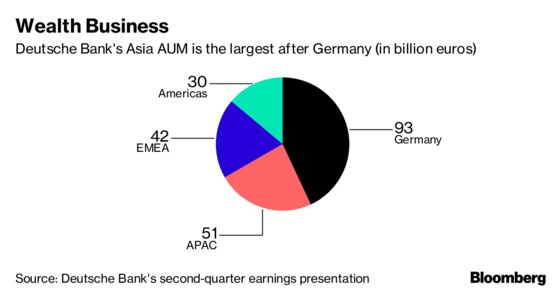

Asian Assets

The size of wealth assets under management in Asia is second only to Deutsche Bank’s home market in Germany, though overall growth has been subdued in recent years. Total AUM was 216 billion euros ($251 billion) at the end of June, little changed from a year earlier.

Yim said the bank had a strong first half in Asia with “a lot of client activity in the first quarter that carried momentum into the second quarter.” AUM in the region edged up to 51 billion euros ($58.46 billion) at the end of June, from 47 billion euros ($53.87 billion) a year earlier, which Yim said was due to both new money inflows and movement in the value of financial assets.

Yim expressed optimism that the recent hiring of relationship managers will bring more rich clients to the bank. “With new colleagues coming on board we are hopeful that we will, over a reasonable period of time, bring new clients onto the Deutsche platform,” Yim said.

Despite recent market volatility, Deutsche Bank is advising its wealthy clients in the region to maintain their investments rather than move into safe havens like cash, Yim said. “We do not feel that this is a time to stay in cash. If anything, we remain fully invested but in a hedged environment.”

Private banks across the region are expanding headcount. At the 20 largest firms, the number of relationship managers in Asia excluding China onshore climbed 7 percent from a year earlier to 5,843 in 2017, according to data compiled by Asian Private Banker. Deutsche Bank was 13th by assets under management, the figures show.

Yim said he is looking to technology and a focus on certain countries and markets in order to contain costs and “sustain profitability” at a time when he is adding new bankers. For example, the bank has exited the wealth business in Australia and Japan in recent years, and no longer serves European clients from Asia, Yim said.

“We want to grow, but sustainably and safely,” Yim said. “But we are not going to hire people for the sake of hiring.”

Bloomberg

The post For Deutsche Bank, rich Asian millionaires drive strong growth opportunities appeared first on DealStreetAsia.

ایده ها برای استارت آپ موجب رونق کسب و کارهای اینترنتی

آینده / استارت آپ

استارتآپها ادبیات بازار سرمایه را بلدند؟

استارت آپ

صدور تاییدیه دانش بنیانی شتابدهنده صدر فردا

اخبار / استارت آپ

اپلیکیشن شارژاپ

گوناگون / استارت آپ / رپرتاژ آگهی / بازتاب

جذابترین ایدههای B2B در سال 2020

استارت آپ

تعریف استارت آپ startup

دانشنامه / استارت آپ / مقاله

۱۰ استارتاپ که بدون سرمایه به سوددهی رسیدند

استارت آپ

ایده ها و پیشنهاد برای استارت آپ در سال جدید

راهکارها و ترفند ها / استارت آپ

استارتآپ ایرانی؛ مرجع اول زنان افغان

استارت آپ

شروع یک کسب و کار نوپا پلتفرمی

استارت آپ

برنامه شبکه اجتماعی تیندر

گوناگون / معرفی وب سایت / استارت آپ

10 استارت آپ برتر تاکسیرانی جهان

استارت آپ

پخت پیتزاهای هیجان انگیز با هوش مصنوعی

آینده / استارت آپ

ایده های استارتاپی فراموش شده

دورنما / بازار / استارت آپ

اپل، استارتاپ فناوری خودران Drive.ai را تصاحب کرد

استارت آپ

بررسی مهمترین چالشهای تیمهای استارتاپی

استارت آپ

نگرانی کاربران از هزینه تعمیر و تامین قطعات

گفت و گو / بازار / استارت آپ

مصاحبه با مدیرعامل و بنیانگذار استارتاپ Moz

گفت و گو / استارت آپ

آشنایی با استارت آپ های حوزه مدیریت آب

استارت آپ

راه اندازی ۷۰ استارت آپ توسط نخبگان ایرانی

استارت آپ

معرفی هشت استارتآپ موفق ایرانی در حوزه فینتک

استارت آپ

اولین مرورگر شرعی دنیا

استارت آپ

از صفر تا پیست

استارت آپ

معرفی برترین استارتاپهای CES 2019

اخبار / استارت آپ

ازدواج با فرد ثروتمند یا خوش اخلاق

سبک زندگی / برترین ها

هدف از تشکیل خانواده چیست

سبک زندگی

اول عاشق شویم، بعد ازدواج کنیم

سبک زندگی

خانواده چیست

سبک زندگی

مشاوره خانواده چیست؟

سبک زندگی

اولویتهای پسانداز خانواده چیست؟

سبک زندگی

هزینه های خانواده چیست؟

سبک زندگی

راهکار بیشتر حرف زدن اعضای خانواده چیست؟

سبک زندگی

چرخه زندگی و خانواده چیست؟

سبک زندگی

اهداف و اصول تشکیل خانواده

سبک زندگی

آموزش جنسی نادرست به سبک خانم جلسه ای

سبک زندگی

لطفا تماشاچی آزار زنان نباشید!

سبک زندگی

کودک آزاری؛ از نشانهها و دلایل تا درمان

گزارش / سبک زندگی / پرورش کودکان

روش های تعیین هدف و مسیر زندگی برای رسیدن به موفقیت

سبک زندگی

مجله اینترنتی دیپروتد نشریه مجازی بر بستر اینترنت به مسائل آموزشی و مقالات پیرامون کسب وکار های نوپا یا استارت آپ ها و سبک زندگی است فعالیت و محتوای مطالب ارائه شده در سایت همه بیشتر در حوزه مدیریت، کارآفرینی ، روانشناسی ،اقتصادی و فناوری اطلاعات است نام اصلی دیپروتد "ریشه های عمیق " با مجوز رسمی از هیات نظارت برمطبوعات مشغول به فعالیت است

ما را در شبکه های اجتماعی دنبال کنید

تمامی حقوق برای سایت فوق محفوط است.

S-TECH: ایرانی توانمند | Powered by: مجله اینترنتی دیپروتد